By Ramsey N Singbeh Jr

Email: director@news.throngtalk.com

Contact: +231772641146 / 880147358

The World Bank Group (WBG) says the fate of emerging markets and developing economies are sure about entering the 2nd quarter of the 21st Century with per capita on a trajectory that implies feeble catch-up toward advanced economies.

It says though global growth is expected to be stable at 2.7 in 2025 to 2026, most low incomes countries are not on course to graduate to middle income status by 2050.

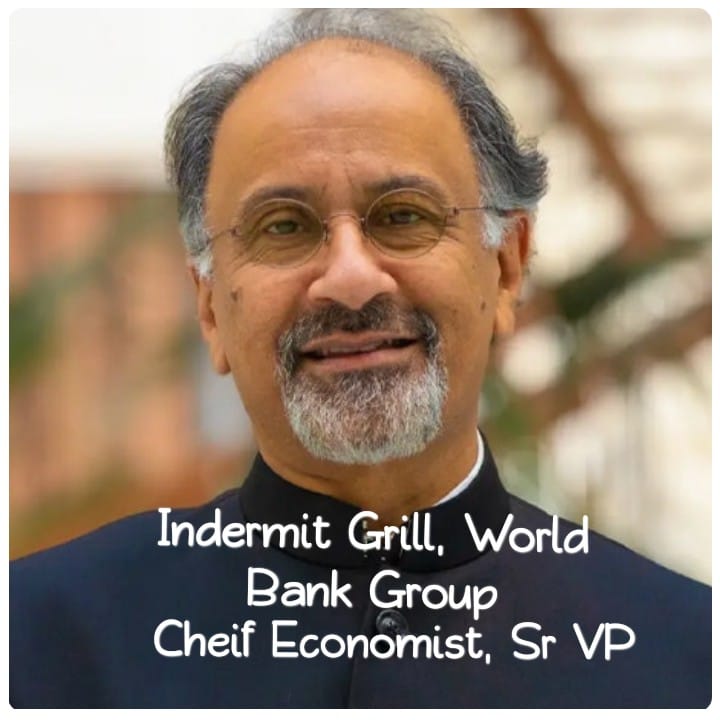

According to the Senior Vice President and Chief Economist of the World Bank Group, Indermit Grill, developing economies now face fierce headwinds: weak investment and productivity growth, aging populations in many of the poorest countries rising geographical tensions and the mounting dangers of climate change.

He cautions them to have no illusion about the struggle ahead. He wrote: “The next 25 years will be a tougher slog than the last 25. A fresh game plan is needed, one that strengthens their capacity to fend for themselves and seize growth opportunities where ever they can be found.”

The World Bank Group Chief Economist and Senior Vice President in his forward added that as the first quarter of the century draws to a close, it is clear that the high development goals of the past few decades will not be met.

The World Bank Group further emphasized the need for policy action, both at the global and national levels to foster a more favorable external environment, enhance microeconomic stability, reduce structural constraints, address the effect of climate change, and thus accelerate long term growth and development.

Global growth, the World Bank says is getting stabilized as inflation returns closer to targets and monetary easing supports activity. “This should give rise to a moderate global extension of 2.7 percent in 2025 to 2026. However, growth prospects appear insufficient to offset the damage done by several years of negative hocks. Heightened policy uncertainty and adverse trade policy shifts represent key downside risks. Other risks including escalating geographical tensions, higher inflation, and more extreme weather events.”